Growth Equity and Equity Capital Markets (ECM)

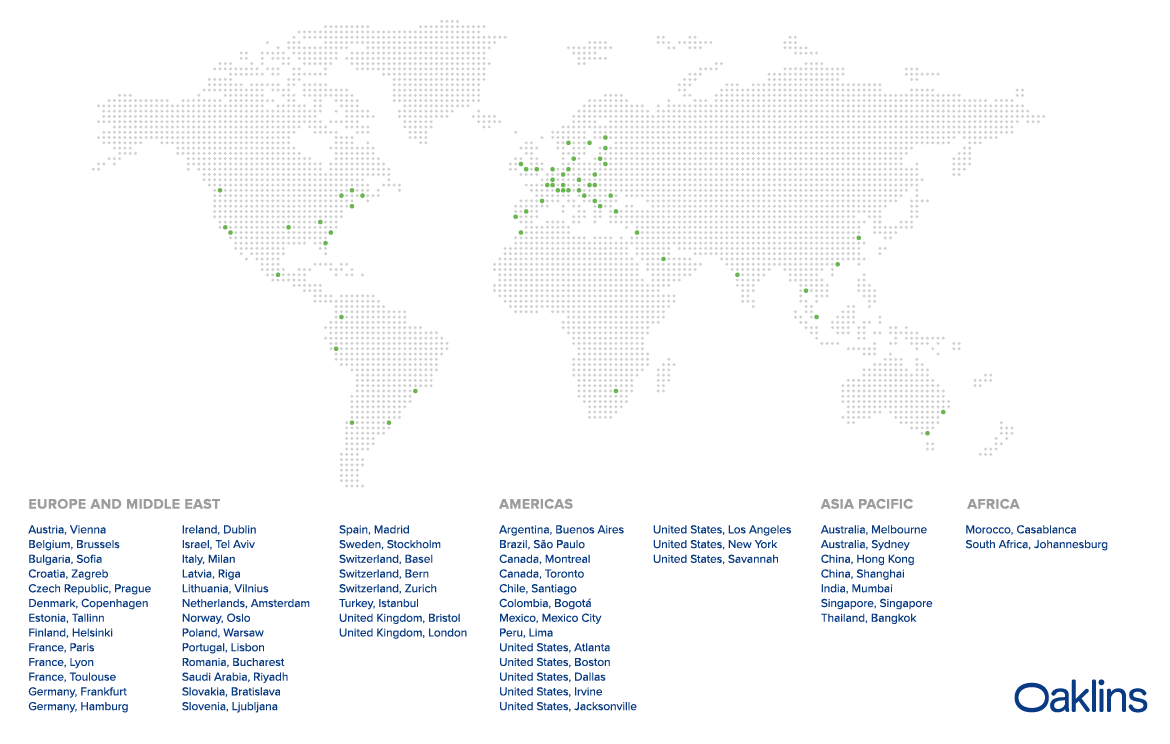

We provide unbiased, conflict-free advice to all of our clients, be they companies, management teams, boards of directors or large shareholders. We provide advice on all facets of capital raising transactions including pricing and valuation of offers, transaction structures and approach and strategy. We have extensive local relationships and networks including private equity and institutional investors. Our Oaklins’ offices extend our reach and networks globally.

Listings and IPOs

Our team have the capability and experience to list companies on the JSE’s Main Board and AltX markets and recently launched competitor exchanges. We provide both practical and strategic advice on the full listing process from valuing the company, restructuring the entity and preparing it for life as a public company, drafting all listing documentation and investor presentation materials, obtaining regulatory approvals and organising and facilitating capital raising road shows. Through the Equity Capital Market teams of various other Oaklins offices, we are able to list companies on selected markets globally as well.

Other Corporate Finance Services

Our team has extensive valuation experience across numerous industries. We offer an independent view and provide valuation advice no matter the purpose or transaction. We are also capable of providing fairness opinions. Our team has experience and expertise in conceiving, facilitating, structuring, negotiating and arranging funding for BEE transactions.